1. Canadian housing market will take another decade to rebalance

Oxford Economics, August 16, 2024 | Link to full report [requires signing up]

Our analysis also finds that CMHC’s aspirational target to build 3.5 million new houses by 2030, on top of those required for household formation, is not feasible and significantly overstates the actual number of new dwellings required to restore affordability.

Construction capacity constraints, worker shortages and other challenges make the requisite near tripling of the current pace of new home building almost impossible.

2. Catch-’23: Canada’s Affordability Conundrum

While most will argue for a supply-side fix, our longstanding view has been that it’s wishful thinking to believe that an industry, already running at full capacity, can simply double output in short order, flood the market with new units and bring prices and rents down.

[…]

The point is that supply has indeed responded in recent years, and yet the affordability needle has barely moved. [sic]

3. Inside The Financing Challenges Developers Are Facing With Rental Projects

As the population of renters continues to grow in Canada, the need for more rental housing also continues to grow. Thus, it is important to understand the challenges developers face, since they provide a vast majority — 95% according to a recent CMHC estimate — of housing in Canada.

[…]

Rental projects are financed differently than condo projects and also generate revenue differently, with a rental building starting to sustain itself only after it is occupied and then taking years to provide a real return.

[…]

What this illustrates, says Ernst & Young, is an "uneven playing field in the capital markets" where the major lenders prefer the bigger developers and the smaller developers are left out in the cold. Finding a loan is also only half of the challenge, with the other half being the interest rate the loan carries.

4. Killam reports 'largest rental gains' on new leases in company's history in most recent update

Killam has previously told CBC News that it's a provider of affordable housing in Halifax, and that the private market alone won't address the housing crisis.

[…]

Killam's financial results show there's a large need for public and other forms of non-market housing, where rents are kept lower, said Cape Breton University associate professor Catherine Leviten-Reid.

5. Big money bets big on B.C. rental: 'Good news' for investors, 'worst fears' for residents

Vancouver Sun, August 15, 2020

“If you’re an investor, you’re loving double-digit returns on your investment. There’s nothing illegal about it, that’s what investment is: You invest and you hope for a big return,” Armstrong said. “But the problem is when you ‘financialize’ housing that way, the consequences for people who need an affordable place to live is a little different than if you’re investing in widgets.”

[…]

Starlight has highlighted their business model in other markets, through their own materials and regulatory filings, the Globe and Mail reported in November, including a 174-unit Toronto rental building they’d acquired where they increased average rents by $411 a month over four years.

[…]

“We think there is a definite housing shortage, or almost a crisis level in Canada … and the good news for investors is there is no easy solution in sight. … This is not good news for consumers.”

6. Why big Halifax landlords are reporting average rent increases above N.S. cap

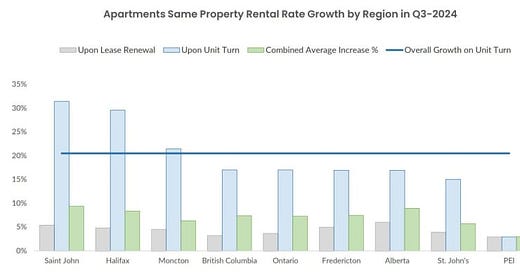

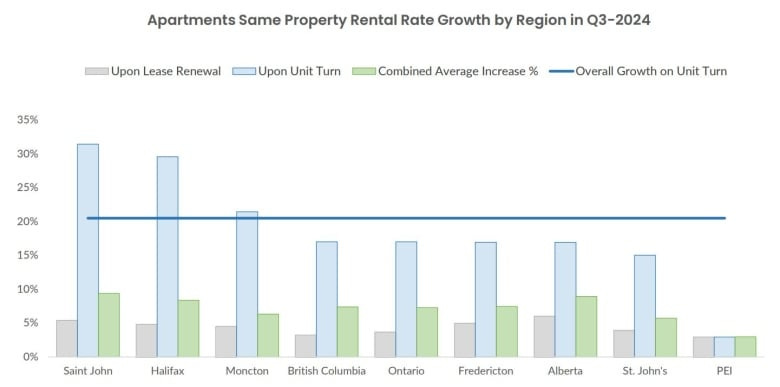

An impending change to the rent cap was discussed during Killam's August earnings call. Starting next year, landlords will be able to increase rent by five per cent for tenants who are renewing their leases.

During the call, chief financial officer Dale Noseworthy said she doesn't think the cap increase will bring rents close to their market value. Because of that, the company will "continue to see lots of opportunity" on turnover apartment units "even after ... we get that five per cent bump," she said.

[…]

Fraser said housing is the largest source of wealth most people have. "It is for-profit, there's no other way to sort of talk about it," he said. "When did it become bad to make money in this country?"

[…]

"It really seems to be that they [REITs] are being painted with the general broader criticisms of having an overreliance on a housing market that's driven by profit, to meet the needs of those that really can't be met by that type of system," he said.

This issue of a lack of non-market housing is where CEOs, advocates and researchers find common ground. They point to public housing — something the province recently re-committed to for the first time in 30 years — as a solution for people who can't afford market rent.

Fraser said the private market is not sufficient to solve the housing crisis. "It needs everybody participating in the right way, trying to do their part."